The OODA Loop

Make decisions like a soldier

Investing principles applied to life: Clear thinking.

With its intensity and enormous risk, a battlefield is beyond any relatable framework for most. However, its volatility, uncertainty, complexity, and ambiguity aren’t limited to war only, meaning that military tactics created to thrive among such attributes can help us in several arenas of life, including investing.

The ability to make good decisions is important. Yet, it’s not always easy to articulate the process that leads to these decisions. Much like the state of flow in work or being in the zone during sports, some good decisions are simply made in a state devoid of clear reasoning or logic. But this isn’t the case on every occasion. Establishing certain rules to depend on serves as a useful tool in situations where clarity is lacking.

Colonel John Boyd

Originating from the military, the term VUCA (acronym for volatility, uncertainty, complexity, and ambiguity) has found broad usage in describing everything from business, sales, marketing, and politics to sports, financial markets, and even personal life.

With the military challenges that VUCA describes, another acronym has been developed to counter these hurdles – the OODA loop.

Nicknamed 'Forty-Second Boyd,' the legendary U.S. Air Force Colonel John Boyd was known for his ability to defeat an opponent in a very short amount of time.

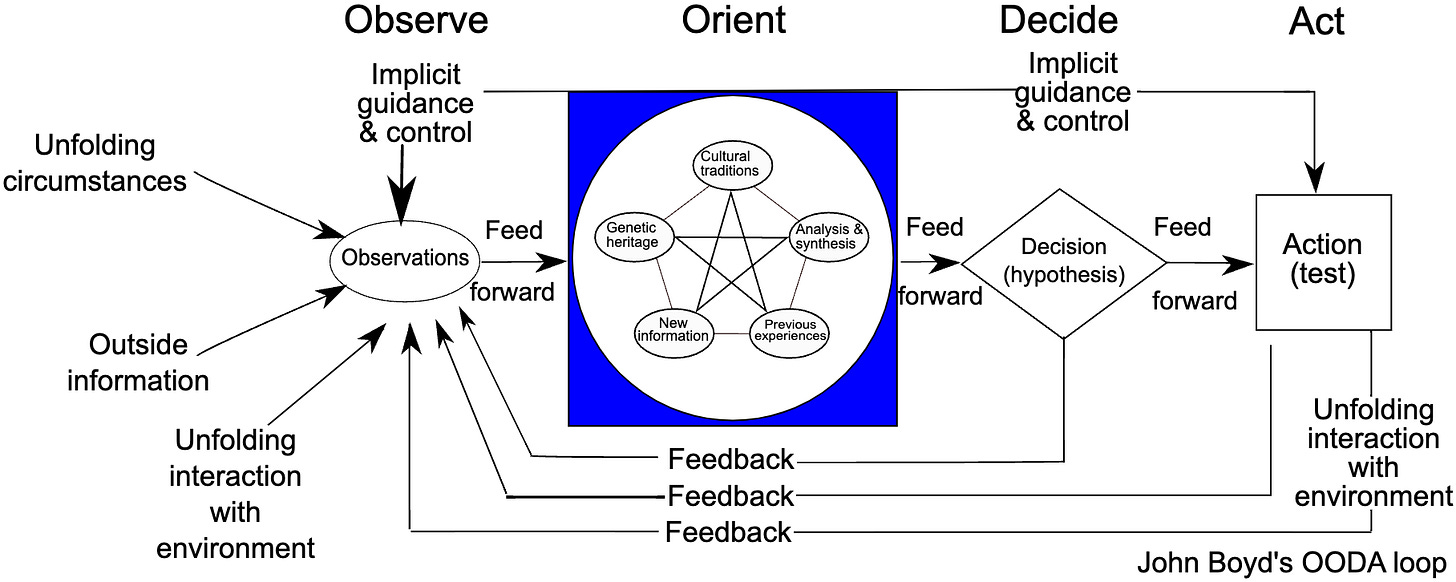

After numerous successes during WWII, the Korean War, and the Vietnam War, reflections on his ability to swiftly act on well-processed judgments in complex situations led him to coin the term 'OODA loop' – a four-step mental model for decision-making, comprised of Observe, Orient, Decide, and Act.

The OODA loop

Observe: Gathering relevant information and data to gain an overall understanding of the situation is important. Observing is an art that needs to be cultivated. What information are we after, and how do we collect it? Remember, not all data is relevant; we need to identify the signal among the noise.

Orient: This step involves using the information collected in step 1 to make sense of the situation we find ourselves in. That’s why it’s crucial to analyze and interpret the collected data in the context of the situation. Be aware of personal characteristics, previous experiences, and biases when interpreting data.

Decide: The previous two steps laid the foundation for an informed decision. At this stage, we decide on a strategy. This step is also referred to as the hypothesis stage, which is why it’s separated from the final step of acting: we create a hypothesis to explore its flaws, and then adjust until it sits right with us. Boyd cautioned against first-conclusion bias here.

Act: Implementing the decided strategy. Once you've made up your mind, it’s time to swiftly respond to the decision by taking action.

A dynamic model

It’s important to note that a mental model like this is designed as a dynamic loop, meaning that each step in itself can provide valuable feedback to previous steps. That’s why it’s intended to be repeated again and again.

Both deciding on a hypothesis (step 3) and testing an action (step 4) will bring forth information about a situation that wasn’t easily observable to start with. Only by going through the steps of deciding and testing will the understanding of a situation be enriched.

Some situations can only be acted upon once, while other situations invite us to test our actions and assess their effects over and over. But even when faced with a one-and-done scenario, the more we embrace this mode of thinking, the better equipped we become to gather and interpret relevant data for future scenarios resembling past ones.

OODA and investing

The legendary investor Bill Miller has said, “We think there are three sources of edge in markets — informational, analytical, and behavioral.” However, he admits that he and his firm have largely focused on having a behavioral edge, meaning a firm and grounded temperament. When he makes a decision and acts upon it, his edge is patience and psychological resilience to tackle adversity. This is probably what most investors should strive for. But he doesn't dismiss the other steps, and neither can we.

In every investment, gathering information is crucial. Without reliable information, competent analysis becomes impossible, and without competent analysis, there is no foundation for making sound decisions.

When gathering information, it's essential to see the forest for the trees, avoiding getting too caught up in details and potentially missing the bigger picture. Simultaneously, we must remain mindful of the details that are of importance.

Now, onto the fun part: interpreting and analyzing the accumulated information. This involves a creative process that encourages us to envision various scenarios, each with its own assigned probabilities.

Once we've crafted a hypothesis that we're satisfied with, it's time to act upon it. Now, we're in a position where our behavioral edge can thrive. But keep in mind, a hypothesis followed by an action can still provide valuable feedback to the steps of 'observe' and 'orient.'

To end

Mastering decision-making is a lifelong journey of baby steps. There are several different mental models we can adopt to help us out, and OODA is only one of them. But before we get ahead of ourselves on the journey toward improved judgment, a good way to start is by simply reflecting on the steps we take before making a decision. The simple steps of observing, orienting, deciding, and acting lend us a tool with which to begin.